China has one of the most advanced digital payment ecosystems in the world. While credit cards dominate in many Western markets, China has effectively leapfrogged into a mobile-first, wallet-driven economy. For any business looking to enter or grow in China, understanding how online payments work is not optional — it is foundational.

China Is a Mobile Wallet Economy

In China, cash and credit cards are secondary. Daily transactions — from e-commerce and subscriptions to taxis and street food — are handled through mobile wallets.

Two platforms dominate:

- Alipay (支付宝) – part of Ant Group and widely used in retail, travel, and financial services.

- WeChat Pay (微信支付) – integrated into the WeChat super-app and essential for social commerce and mini-program experiences.

Together, these platforms handle billions of transactions and are deeply embedded in consumer habits.

Case Examples of Western Brands in China

Here are real examples of how Western brands operate with China’s online payment ecosystem:

– Apple and Local Wallets

Apple launched Apple Pay in China in 2016, partnering with China UnionPay to enable contactless NFC payments on iPhone and Apple Watch for local bank cards.

However, Apple Pay adoption has been relatively limited compared with Alipay and WeChat Pay, which dominate QR-code-based mobile payments. The inconvenience of NFC-only acceptance and lack of social or ecosystem features means Apple Pay’s share remains small in the broader mobile payments market.

To better serve Chinese users, Apple also expanded in-app payment options in the China App Store to include WeChat Pay and Alipay, meaning customers can purchase apps and subscriptions using local wallets instead of only Apple Pay.

(Read more about how we have dived deep into Apple’s digital presence in China.)

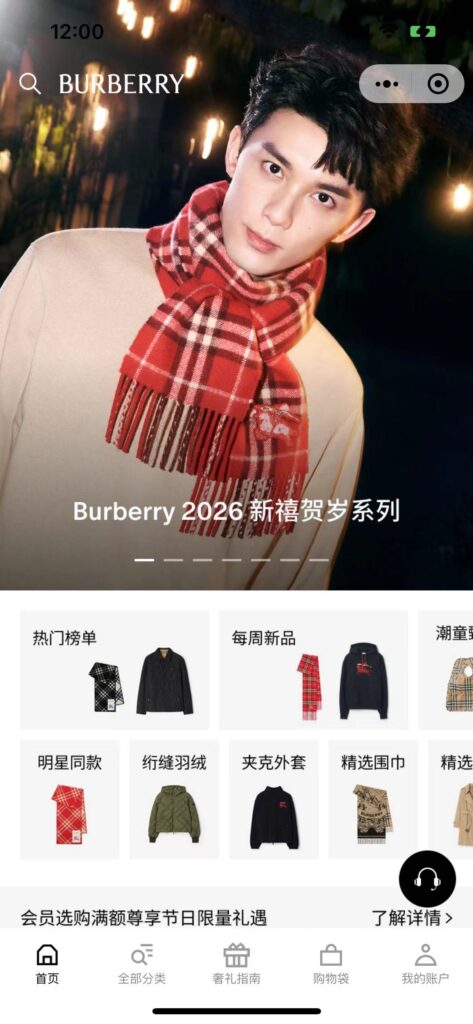

– Burberry on WeChat

Luxury fashion brand Burberry has run successful campaigns on WeChat, including flash sales and interactive mini-program experiences tied to local festivals like Qixi (Chinese Valentine’s Day). These integrated strategies use WeChat Pay to boost engagement and conversions with Chinese consumers.

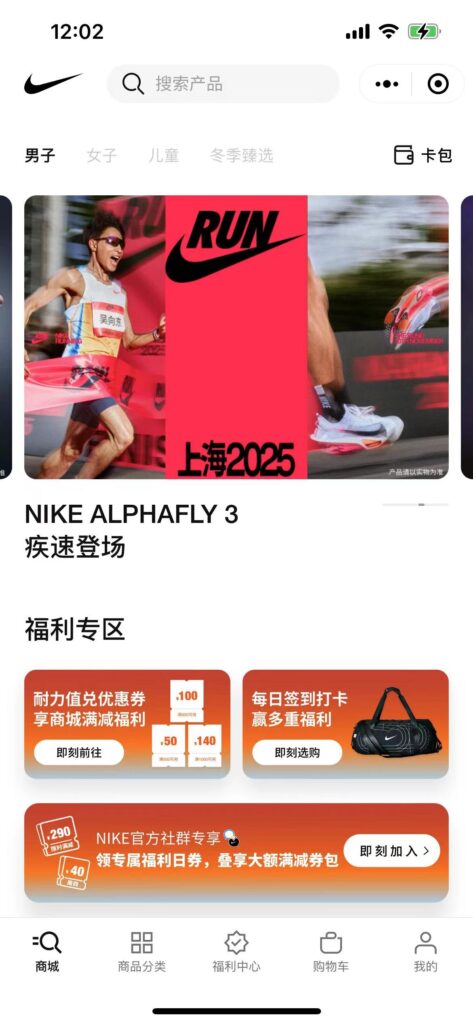

– Nike’s WeChat Campaigns

Nike used WeChat to launch interactive campaigns involving quizzes, user-generated content, and mini-programs where users could customise sneakers and participate in raffles. These experiences tied social engagement directly to payment and purchase behaviour.

Credit Cards Are Not the Default

Unlike Western markets, Visa and Mastercard are rarely used online in China. Instead, Alipay and WeChat Pay handle the majority of both online and offline payments.

The local credit payment, including UnionPay, exists but remains secondary to mobile wallets. In most cases, users expect scan-and-pay (QR code) or in-app checkout — not manual card entry.

WeChat Pay vs Alipay: Different Strengths

Although similar, the two platforms serve different purposes:

– WeChat Pay

- Best for social commerce, messaging-linked transactions, and mini-program promotions.

- Ideal for brands that want to drive engagement and loyalty.

– Alipay

- Preferred for e-commerce, travel, and higher-trust purchases.

- Often leads cross-border payment experiences for international visitors and merchants.

For foreign brands, supporting both is table stakes.

Cross-Border vs Local Payments

Foreign companies typically have two paths:

– Cross-Border Payment Solutions

- Sell directly from overseas.

- Faster setup, but relatively higher fees and slower settlements.

– Local China Payments

- Through a China-registered entity.

- Full integration with local wallets, loyalty systems, and CRM data.

Most long-term players choose the local path to unlock growth and reduce friction.

UX Expectations Are Higher in China

Chinese users expect:

- Instant confirmations.

- Seamless mobile experiences.

- In-app loyalty, coupons, and payment perks.

A poor checkout flow — like redirecting to slow external pages — will cost conversions.

Conclusion

China’s digital payment ecosystem is fast, innovative, and consumer-centric. For Western brands, getting payments right means:

- Supporting Alipay, WeChat Pay, and local wallets

- Designing mobile-first checkout flows

- Treating payments as part of branding, engagement, and growth